Navigate Your Medicare Choices: Medicare Advantage Plans Near Me

Browsing the Registration Refine for Medicare Advantage Insurance

As individuals come close to the stage of considering Medicare Benefit insurance coverage, they are met a maze of options and regulations that can often really feel overwhelming. Understanding the qualification demands, various insurance coverage options, registration periods, and the necessary actions for enrollment can be a powerful task. Nevertheless, having a clear roadmap can make this navigation smoother and a lot more convenient. Let's explore how to efficiently browse the registration procedure for Medicare Benefit insurance policy.

Qualification Needs

To get Medicare Advantage insurance policy, individuals have to fulfill specific eligibility needs outlined by the Centers for Medicare & Medicaid Provider (CMS) Qualification is mainly based on factors such as age, residency condition, and enrollment in Medicare Component A and Component B. A lot of people aged 65 and older receive Medicare Benefit, although specific people under 65 with qualifying impairments might additionally be qualified. Furthermore, individuals have to reside within the service area of the Medicare Advantage strategy they want to enlist in.

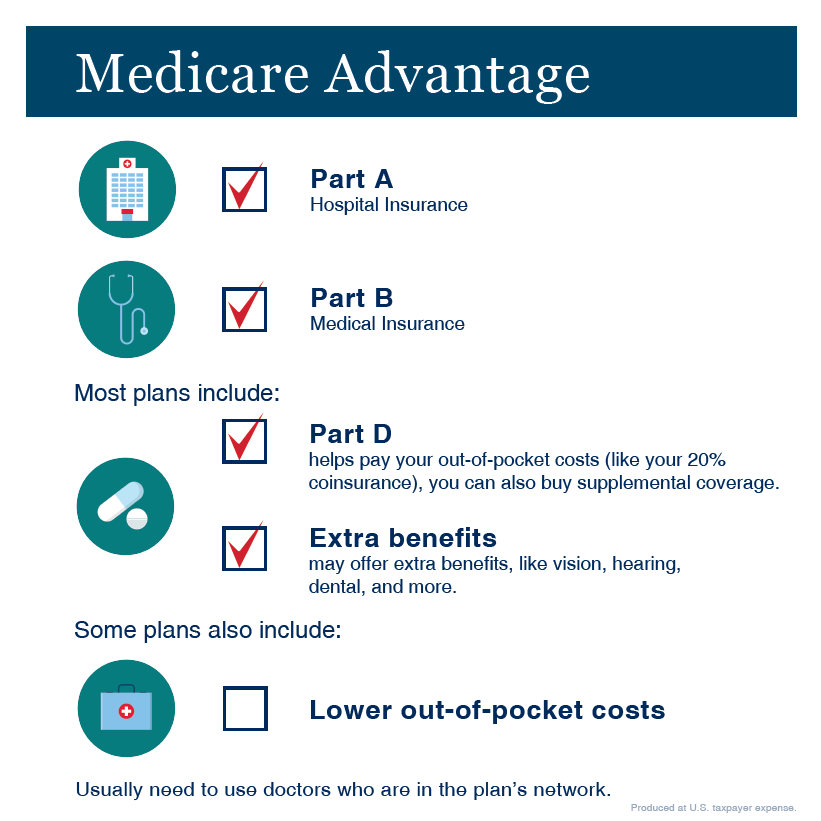

Additionally, individuals must be registered in both Medicare Part A and Part B to be qualified for Medicare Benefit. Medicare advantage plans near me. Medicare Benefit strategies are called for to cover all solutions provided by Original Medicare (Component A and Component B), so enrollment in both parts is required for individuals seeking coverage with a Medicare Advantage strategy

Protection Options

Having satisfied the qualification requirements for Medicare Advantage insurance, people can currently explore the numerous protection alternatives readily available to them within the strategy. Medicare Advantage prepares, also understood as Medicare Part C, use an "all-in-one" choice to Original Medicare (Component A and Component B) by offering extra advantages such as prescription medicine insurance coverage (Part D), vision, oral, hearing, and health care.

One of the key protection choices to consider within Medicare Benefit intends is Wellness Upkeep Company (HMO) plans, which usually need individuals to select a main care physician and obtain referrals to see professionals. Preferred copyright Company (PPO) prepares offer more versatility in selecting healthcare companies without recommendations however commonly at a higher cost. Special Requirements Strategies (SNPs) cater to individuals with particular wellness conditions or those that are dually eligible for Medicare and Medicaid (Medicare advantage plans near me). Private Fee-for-Service (PFFS) intends establish just how much they will pay doctor and just how much individuals will certainly pay when they receive treatment.

Comprehending these protection options is essential for people to make educated decisions based on their health care requirements and choices.

Enrollment Periods

Actions for Registration

Comprehending the enrollment durations for Medicare Advantage insurance policy is important for beneficiaries to browse the procedure successfully and properly, which begins with taking the required steps for enrollment. You must be signed up in Medicare Part A and Component B to qualify for a Medicare Benefit plan.

After selecting a strategy, the following action is to enroll. Medicare advantage plans near me. This can commonly be done during certain enrollment periods, such as the Initial Registration Period, Yearly Registration Duration, or Special Registration Duration. You can register straight with the insurance provider offering the strategy, through Medicare's website, or by Continue getting in touch with Medicare directly. Be certain to have your Medicare card and individual information all set when enrolling. Evaluate your registration verification to guarantee all details are precise prior to coverage starts.

Tips for Decision Making

When evaluating Medicare Advantage intends, it is crucial to carefully assess your specific healthcare requirements and monetary considerations to make an educated decision. To help in this procedure, consider the following tips for decision making:

Contrast Plan Options: Study readily available Medicare Benefit prepares in your area. Contrast their prices, insurance coverage benefits, provider networks, and quality ratings to identify which straightens finest with your demands.

Think About Out-of-Pocket Expenses: Look beyond the month-to-month costs and consider factors like deductibles, copayments, and coinsurance. Calculate prospective annual expenditures based on your healthcare usage to discover one of the most cost-efficient alternative.

Testimonial Star Ratings: Medicare assigns star ratings to Advantage plans based upon factors like client contentment and top quality of care. Selecting a highly-rated plan might suggest much better general efficiency and solution.

Verdict

To conclude, understanding the eligibility requirements, insurance coverage options, enrollment durations, and steps for signing up in Medicare Benefit insurance coverage is important for making informed choices. By navigating the registration process effectively and taking into consideration all available info, people can guarantee they are choosing the best strategy to meet their healthcare needs. Making informed choices throughout the registration process can bring about better health and wellness end results and monetary security in the lengthy run.